A powerful investment platform for digital assets

A new unique client experience

Enlyte is an end-to-end modular investment platform based on distributed ledger technology.

As an independent platform, Enlyte is a pioneer in the industry by transferring the entire investment process into the digital world. This means that Enlyte offers a holistic digital concept instead of covering isolated parts of the value chain.

Enlyte provides a comprehensive white-label offering. For the first time in an investment platform, Enlyte covers all the phases of the investment process, completely digital, on a single platform – from client onboarding, and the issuance of digital assets, to administration and reporting. Asset managers and fund initiators can use the platform to issue, manage and distribute digital assets all from the Enlyte platform.

Enlyte’s End to End Investment Platform

Clients & Partners

Fund Promoters

Be time and cost efficient when issuing funds through the STO solution and gain access to a new range of secure and regulated custody, brokerage, and administration processes.

Institutional Investors

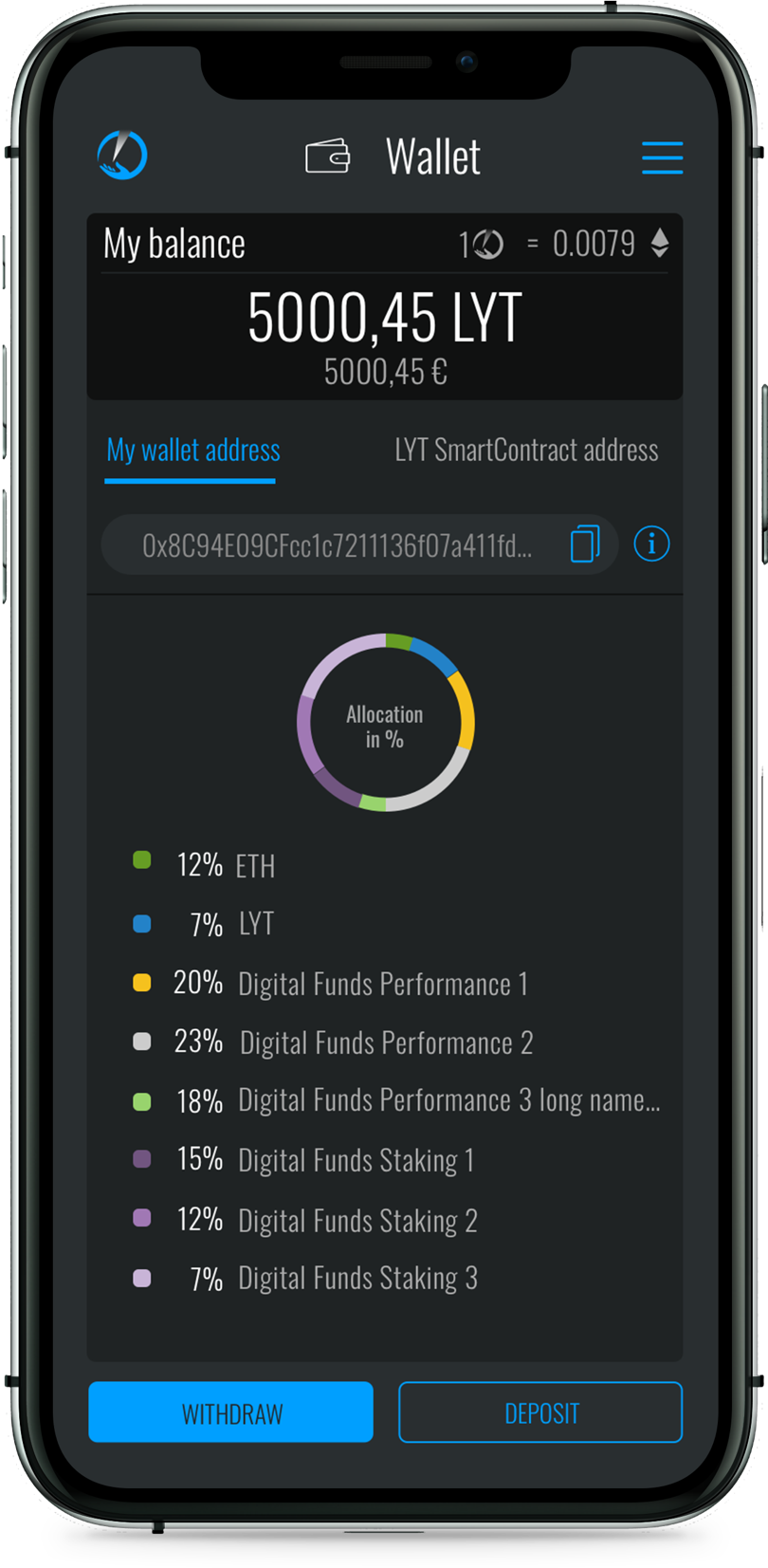

Use Enlyte’s technologically advanced brokerage and custody solutions to gain access to new digital assets and further alternative investments, such as cryptocurrency funds or digitally tokenized assets.

Asset Managers

Provide easily accessible, new investment opportunities in crypto and digital assets for your investors to invest in through Enlyte’s digital fund solution.

Custodians

Easily integrate the Enlyte digital custody solution into your processes and introduce your customers to a secure digital asset custody solution built with state-of-the-art blockchain technology.

Retail Investors

Reach new digital assets to further diversify your portfolio with Enlyte’s technologically and regulatory seamless crypto brokerage and custody solutions.

Business Partners

Collaborate with Enlyte’s holistic digital asset platform and benefit from working with one of fintech’s most advanced platforms in the crypto industry.

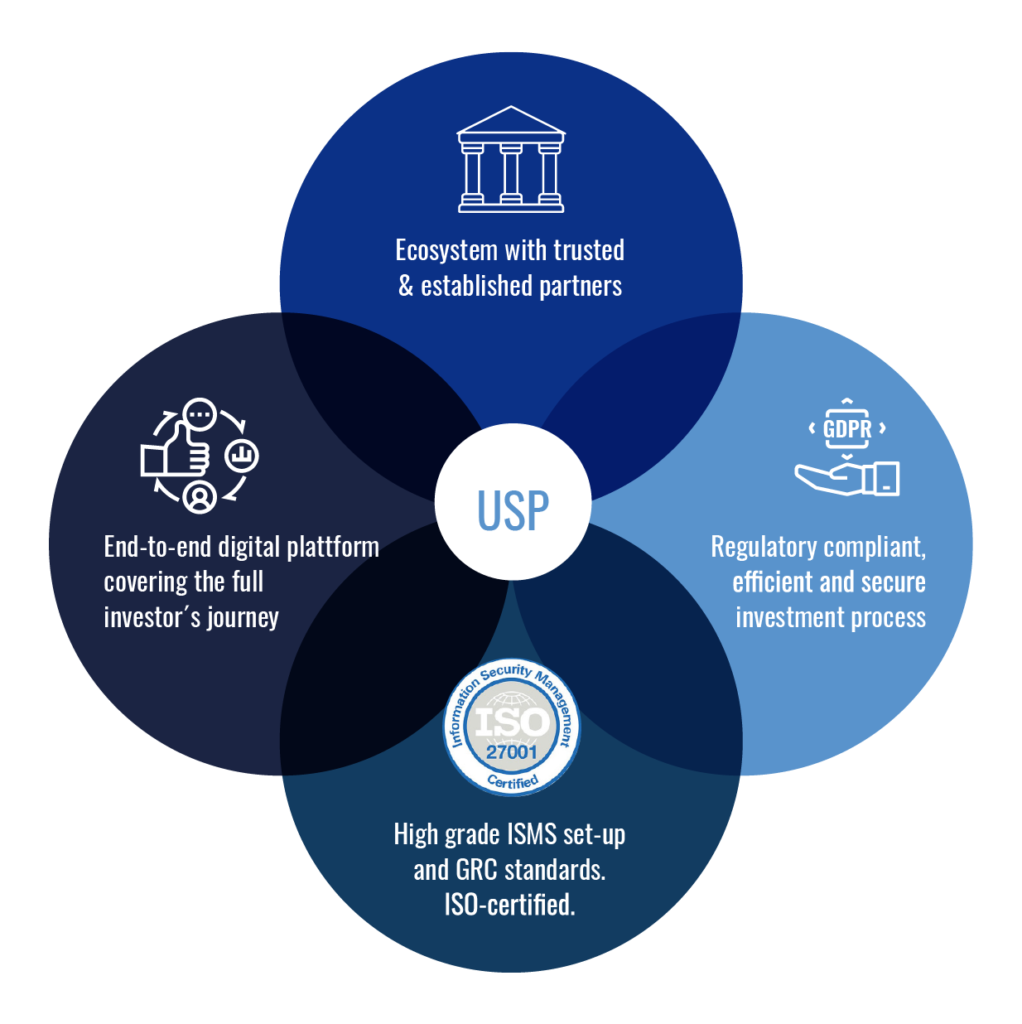

Our USP

Enlyte has a unique selling proposition (USP) due to the combination of four major factors that will provide key competitive advantages.

Key Competitive Advantages of Enlyte‘s USP

- Incumbent players have not a similar offer

- Start ups lack trust and regulatory compliance

- Competitors offer mostly isolated solutions

Enlyte yourself

GET STARTED WITH ENLYTE TODAY

FAQ – Taxonomy

What is Enlyte?

Enlyte is a FinTech company founded in 2020. It offers an end-to end investment platform with all the functionalities that institutional investors, fund promoters and asset managers need to facilitate the order, trading, execution, and custody of digital assets.

Enlyte is a modular investment platform based on distributed ledger technology. As an independent platform, Enlyte is a pioneer in the industry by transferring the full investment process into the digital world. This means that Enlyte offers a holistic digital concept instead of only covering isolated parts of the value chain.

Enlyte provides a comprehensive white-label offering, and it is covering for the first time the main phases of the investment process fully digitally on a single platform – from client onboarding and the issuance of digital assets, administration and reporting. Asset managers and fund promoters can use the platform to issue, manage and distribute digital assets in a regulatory compliant environment.

Where is Enlyte based and when was it established?

Enlyte was established in 2020 and it is based in Frankfurt am Main, Germany.

What is a white label solution?

The Enlyte Platform is a white-label Software as a Service (SaaS) solution. This means that our clients will receive a fully customised platform with their own branding and logo. Enlyte will provide the underlying technical infrastructure and know-how. Through the seamless integration of our white-label custody API, our clients can keep their customers’ digital assets safe, while maintaining full control over their branding.

What is Crypto Custody?

Crypto custody services are the safeguarding and storage of private keys that give access to digital assets. Enlyte offers these services to custodians, institutional investors, issuers, asset managers, etc., to store, safeguard, and transfer digital assets while making them secure, scalable, and usable.

What is a digital fund?

A digital fund wrapper with native digital underlying assets created, recorded, and traded on the Blockchain. Enlyte will also enable the issuance of native digital funds as soon as the regulatory framework allows it.

Contact us